As digital transformation accelerates and cyber threats grow more sophisticated, the demand for autonomous, AI-powered cybersecurity solutions is surging. SentinelOne’s innovative Singularity platform positions it at the forefront of this trend, leveraging advanced AI to deliver real-time, autonomous threat detection and response.

Our analysis will dive into SentinelOne’s unique technological approach, strategic partnerships and market positioning. We’ll also assess how macroeconomic factors, increasing regulatory requirements and the rise of cloud-native and endpoint security are shaping the cybersecurity landscape. Join us as we explore whether SentinelOne has the edge to become a leading player in this critical, high-growth industry.

Executive Summary

Key Highlights:

■ Case study: The cybersecurity market continues to grow at an accelerated pace, with spending projected to exceed $200 billion by 2026. McKinsey reports that AI-driven cybersecurity solutions, which offer automated and scalable threat detection and response, are gaining momentum in response to increasingly complex cyber threats. SentinelOne (NYSE: S), a leading provider of AI-powered cybersecurity, demonstrated notable performance improvements in Q2 FY2025, driven by enhanced operational efficiency and revenue growth. The company's Singularity XDR platform, which combines endpoint, cloud and identity protection, positions it to capture a substantial market share in a rapidly expanding industry.

■ Key highlights:

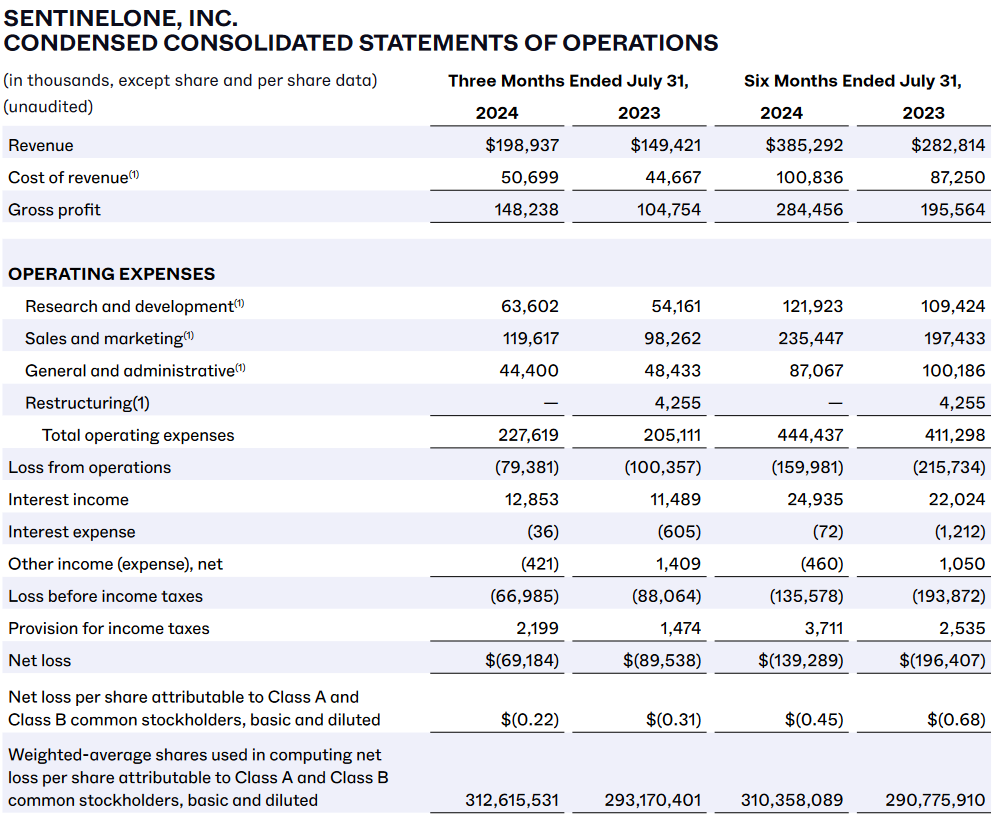

• Q2 Performance: SentinelOne achieved record highs in revenue, gross margin and operating margin. Q2 revenue grew 33% year-over-year (YoY) to $199 million, while Annualized Recurring Revenue (ARR) increased by 32% to $806 million.

• Scalability and profitability: non-GAAP gross margin reached 80% and non-GAAP operating margin neared break-even. The company recorded its first positive non-GAAP net income and earnings per share, indicating operational scalability and improved profitability.

• Demand drivers: broad-based demand across customer segments and geographies supported revenue growth. The company’s new customer acquisition strategy led to a 24% YoY increase in customers generating over $100,000 ARR and a company record in customers exceeding $1 million ARR.

■ Company description and overview: SentinelOne provides autonomous cybersecurity solutions powered by AI, offering real-time threat detection and response. The company’s Singularity XDR platform integrates endpoint, cloud and identity protection into a single, scalable solution designed for enterprises of all sizes. The platform’s innovations, such as Purple AI, offer next-generation generative AI capabilities that streamline security operations by enhancing threat detection and response.

1. Cybersecurity landscape

“According to Cybercrime Magazine, cybercrime would have a value equivalent to the third-largest economy globally, at $10.5 trillion annually by 2025, while Statistica suggests it will rise to $13.8 trillion by 2028. The demand for cyber security will rise dramatically and AI can help in this process. Current processes cannot keep up with the volume of malware, estimated at around 1 billion programmes with 560,000 new pieces each day according to DataProt20. AI automation can help to detect and differentiate between those that are most harmful21. Our analysts expect Security vendors to emerge as beneficiaries across both the infrastructure and application layers as well as within data posture investments as security continues to trend higher as a percentage of total budgets” - reported Goldman Sachs in their latest research.

A recent McKinsey survey highlights a significant market opportunity of up to $2 trillion for cybersecurity providers, driven by the proliferation of cyberattacks that are causing nearly $10.5 trillion in projected annual damages by 2025, a 300% increase from 2015 levels. In 2021, global cybersecurity spending was around $150 billion, growing at 12.4% annually, yet this only addresses 10% of the potential market. Key drivers include the demand for automation, cloud security, AI-based solutions and managed services, especially for SMBs vulnerable to cyber threats like ransomware. McKinsey suggests that providers must innovate on pricing, technology and service delivery to unlock this immense, underserved market potential (Aiyer, Caso, Russell, & Sorel, 2022).

2. Company analysis

■ Q2 Earnings results summary: In Q2 FY2025, SentinelOne reported a 33% YoY increase in revenue, totalling $199 million. ARR grew by 32% to $806 million, outperforming initial projections by a double-digit margin. This growth was fueled by expanding enterprise adoption and increased global penetration. SentinelOne’s improved margins underscore its effective scaling and cost management strategies.

■ Revenue growth:

• Revenue: $199 million (Q2 FY2025), up from $149 million in Q2 FY2024.

• Projected Full-Year revenue growth: Approximately 31% YoY, with an FY2025 target of $815 million. This increase reflects strong customer demand and platform expansion.

• Key growth factors: Expansion across larger enterprises, increasing adoption of solutions such as endpoint, data and cloud and the continued success of strategic partnerships.

■ Profitability and margins

• Gross margin: GAAP gross margin rose to 75% (from 70% YoY), while non-GAAP gross margin reached a record 80%.

• Operating margin: non-GAAP operating margin improved to (3)%, nearing break-even and marking a significant improvement from (22)% YoY.

• Free cash flow margin: achieved (3)% in Q2, reflecting a 7-percentage-point improvement from the previous year, largely driven by operational leverage and increased revenue per customer.

2.1 Growth drivers

■ Key growth drivers:

• Broad enterprise demand: SentinelOne’s platform adoption surged across large enterprises, with a 24% YoY increase in customers generating over $100,000 ARR.

• Product expansion and AI innovation: SentinelOne’s emerging solutions, including Purple AI and cloud security offerings, outpaced overall growth rates, indicating strong market acceptance.

• Strategic partnerships: expanded partnerships with managed security service providers (MSSPs) and integrations with the federal sector further diversified revenue channels.

2.2 Valuation

Current share price:

Current price: $25

Market capitalization: approximately $7 billion

Multiples

EV/Sales (Fwd): 9.5x, slightly below CrowdStrike (10.8x) but higher than Palo Alto Networks (8.7x), reflecting a premium for SentinelOne’s growth potential.

P/S Ratio: 10.2x, aligning with high-growth peers in the cybersecurity sector.

DCF Valuation

Based on a DCF model, SentinelOne’s intrinsic value is estimated at $28 per share, suggesting moderate upside with a 1-year target of $30.

o Key Assumptions:

Revenue CAGR (2024-2029): 28%

Discount rate (cost of capital): 10%

Terminal growth rate: 3%

Break-even: positive free cash flow expected by FY2026 as growth scales profitably.

■ Financial outlook:

o Quarterly guidance:

Q3 FY2025 revenue target: $209.5 million, representing 28% YoY growth.

Gross margin: non-GAAP gross margin is expected to stabilize around 79%.

Operating margin: non-GAAP operating margin target of approximately (3)%.

o Full-Year guidance:

FY2025 revenue: expected at approximately $815 million, indicating a 31% YoY increase at the midpoint.

Full-Year gross margin: expected to be around 79%.

Full-Year operating margin: non-GAAP margin of (5)-(3)%, reflecting operational efficiencies and improved scale.

2.3 Thesis, catalysts and risks

■ Thesis:

SentinelOne’s autonomous AI-driven platform positions it uniquely to meet the cybersecurity needs of enterprises globally. The demand for advanced, automated security solutions has accelerated as organizations prioritize resilience and response speed in the face of evolving cyber threats.

■ Catalysts:

Customer expansion: record growth in ARR from new and existing customers, including a significant increase in larger enterprise clients.

Strategic alliances: expanded partnerships with entities like Google Mandiant and federal agencies support new revenue channels and strengthen SentinelOne’s competitive edge.

Product and platform growth: high adoption of emerging solutions such as Purple AI and cloud security demonstrates SentinelOne’s innovation capabilities and enhances market differentiation.

■ Calendar:

Q3 FY2025: Anticipated revenue of $209.5 million and a gross margin of 79%.

FY2026-FY2027: Targeted improvements in operating margins and progression toward sustained profitability.

Long-Term Goal (FY2029): Aiming for positive net income through revenue expansion and operational efficiencies.

■ Risks:

High competition: SentinelOne competes with large, established players such as CrowdStrike and Palo Alto Networks, posing risks related to pricing and market share.

High cash burn: Continued R&D investments and expansion efforts require significant cash outflows, increasing reliance on existing cash reserves.

Macroeconomic factors: Economic downturns or budget constraints could impact client spending, potentially slowing revenue growth.

3. SWOT analysis and analyst recommendations

■ Strengths:

Market-leading AI technology with autonomous threat detection and response.

Strong gross margins, with improving operating leverage.

Robust cash position, supporting long-term strategic investments.

■ Weaknesses:

High reliance on large enterprises for revenue growth.

Substantial cash burn, typical of high-growth tech companies.

■ Opportunities:

Expanding internationally and diversifying solutions for cloud and AI-powered security.

Capturing further market share from traditional security providers.

■ Threats:

Competitive pressures and pricing challenges in the high-growth cybersecurity sector.

Regulatory shifts impacting data privacy and cybersecurity standards.

■ Analyst recommendations: Based on 22 Wall Street analysts offering 12 month price targets for SentinelOne in the last 3 months. The average price target is $29.45 with a high forecast of $35.00 and a low forecast of $25.00. The average price target represents a 16.04% change from the last price of $25.38.

4. Conclusions

SentinelOne’s advanced cybersecurity solutions offer a strong value proposition for enterprises seeking automated, scalable defenses. The company’s continued revenue growth, expanding customer base and improved profitability metrics position it as a compelling prospect in the cybersecurity sector. SentinelOne remains attractive for growth-focused investors, with robust market potential and demonstrated progress in operational efficiencies.

Bibliography

McKinsey & Company. "New survey reveals $2 trillion market opportunity for cybersecurity technology and service providers" (2022)

Goldman Sachs. "Global Strategy Paper AI To buy, or not to buy, that is the question" (2024)

Morgan, Steve (2020). “Cybercrime To Cost The World $10.5 Trillion Annually By 2025”

SentinelOne, Inc. Q2 FY2025 Shareholder Letter (2024)

SentinelOne, Inc. OneCon24 Investor Deck (2024)

Yahoo Finance Database

Prepared by AI Monaco

AI Monaco is a leading-edge research firm that specializes in utilizing AI-powered analytics and data-driven insights to provide clients with exceptional market intelligence. We focus on offering deep dives into key sectors like AI technologies, data analytics and innovative tech industries.