Introduction:

As artificial intelligence (AI) continues its meteoric rise, the energy demands of tech giants have soared to unprecedented levels. Oklo, Inc. (NYSE: OKLO), a trailblazing nuclear power startup, stands poised to meet this challenge head-on. Backed by influential tech leaders like Sam Altman and leading the charge with advanced small modular reactors (SMRs), Oklo is strategically positioned to supply the clean, reliable energy that AI data centers crave. Following Google's landmark nuclear power agreement with Kairos Power, Oklo's unique approach to utilizing recycled nuclear waste as fuel places it at the forefront of the clean energy revolution.

Executive Summary

■ Case study: Oklo, Inc. (NYSE: OKLO), a nuclear power startup backed by notable tech figures like Sam Altman, has emerged as a key player in the energy landscape, particularly with the increasing power demands of AI companies. With the recent announcement of Google signing a contract with Kairos Power to supply nuclear-generated electricity to meet its AI data center needs, the spotlight is on nuclear energy solutions for large tech firms. Oklo, which also aims to provide energy to data centers, is set to benefit from this trend. This equity report will explore Oklo’s financials, growth prospects and risks as it positions itself to cater to the energy-intensive demands of artificial intelligence.

■ Key Highlights:

Google's nuclear deal: Google recently signed a landmark contract with Kairos Power, highlighting the growing trend of AI companies seeking nuclear energy to power their operations. Other AI-driven firms are expected to follow this path, creating substantial demand for companies like Oklo that specialize in small modular nuclear reactors (SMRs).

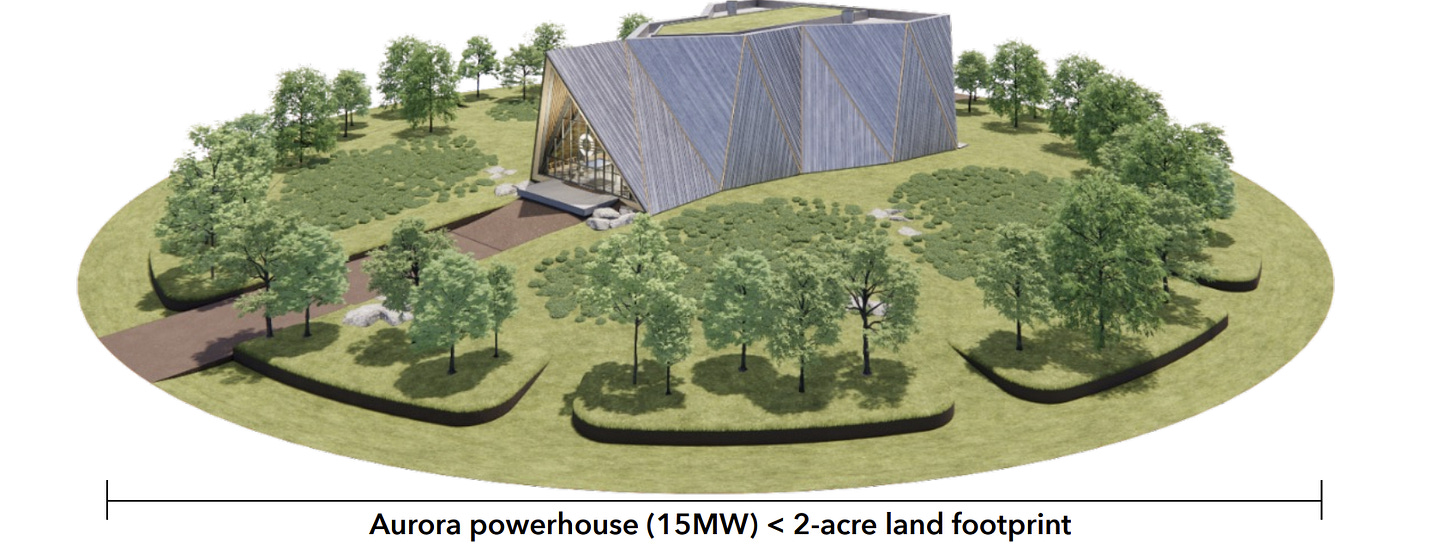

Aurora powerhouse: This will be the first commercial advanced fission power plant in the United States. By integrating a novel business model, cutting-edge technology and a small, scalable design, Oklo is unlocking the future of clean energy.

Potential new upcoming deals: Oklo has already signed a 500MW agreement with Equinix, further solidifying its position in the tech-driven energy landscape.

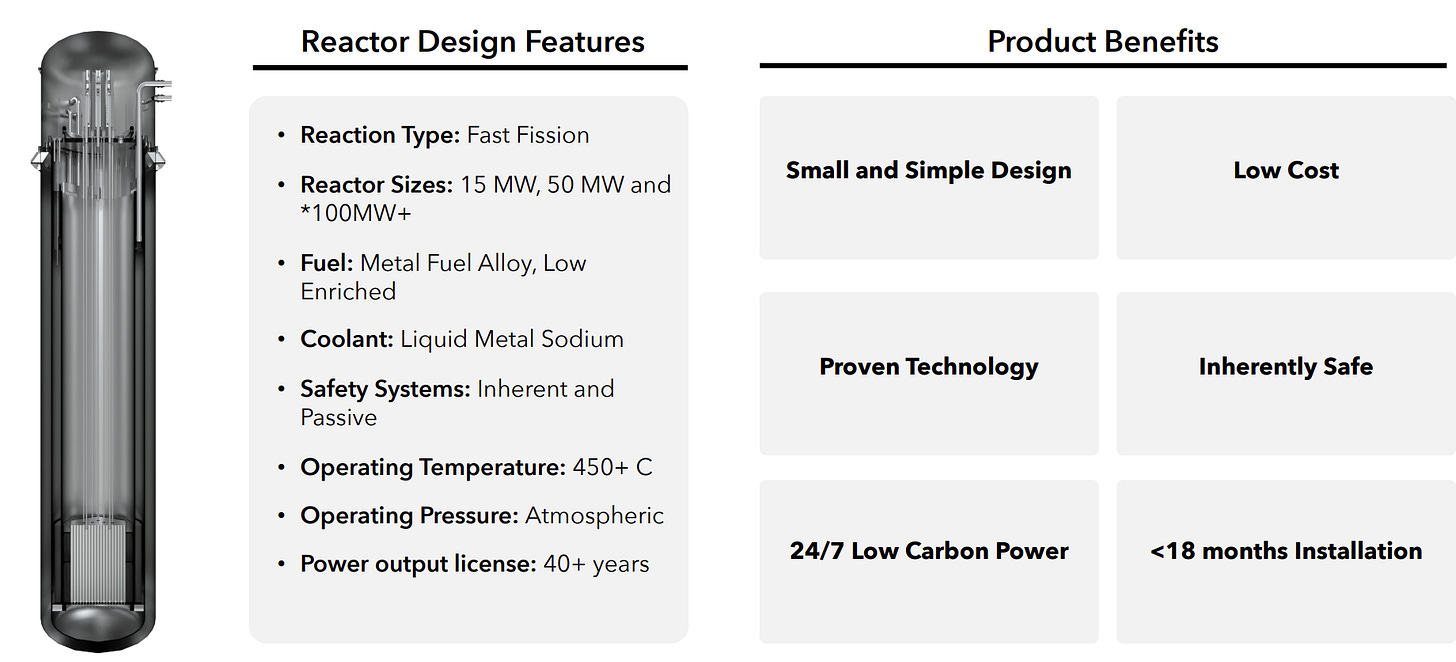

■ Company Description and Overview: Oklo is an advanced nuclear company developing small modular reactors (SMRs) designed to provide clean and reliable power. The company went public through a SPAC merger earlier in 2024 and aims to revolutionize nuclear energy with its cost-efficient, fast-deploying reactors capable of using nuclear waste as fuel. Its first reactor is expected to be operational by 2027, targeting energy-intensive sectors like AI, defense, and heavy industry.

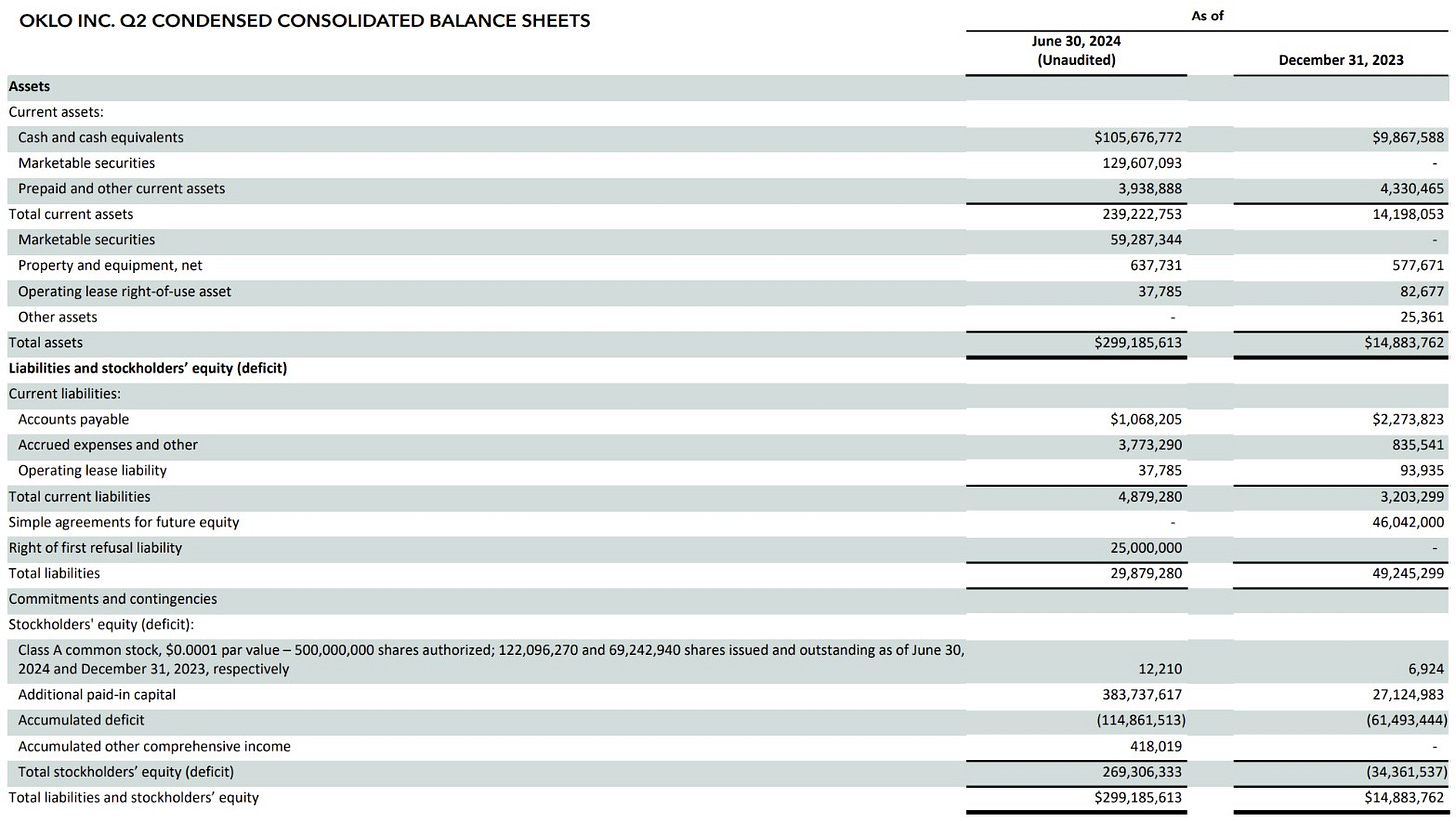

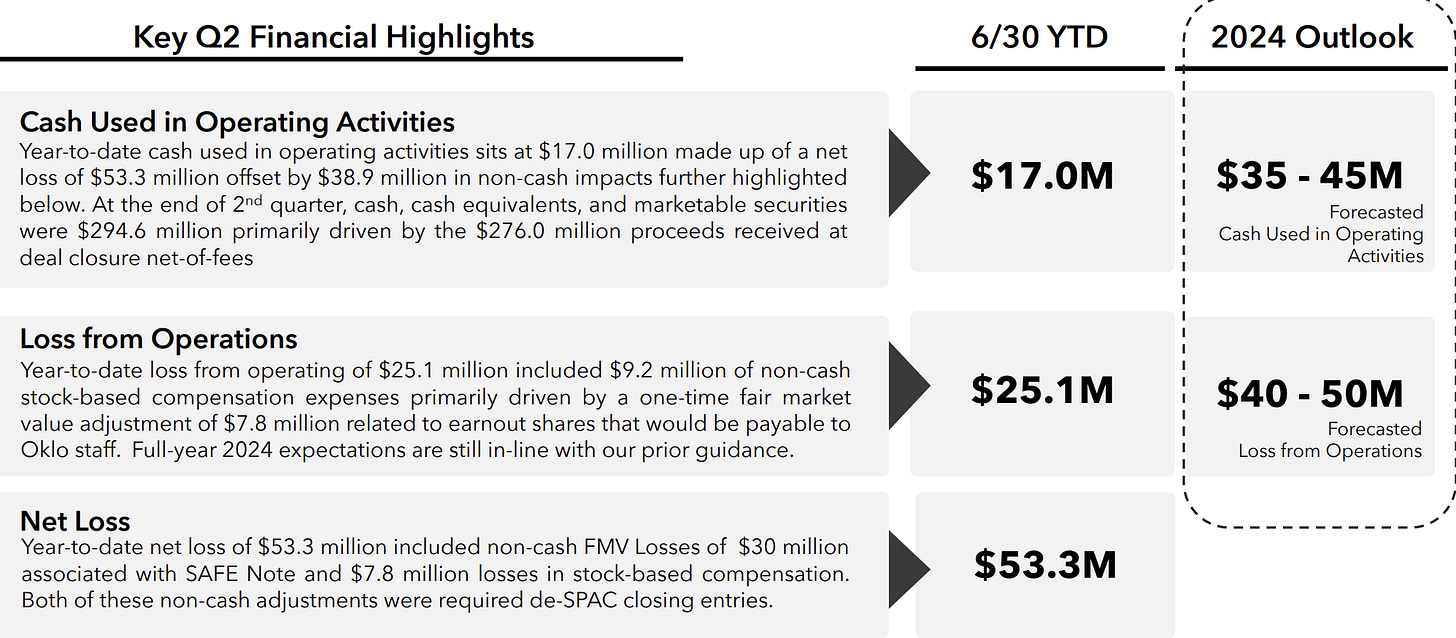

2. Q2 Earning Results

■ Q2 Earnings Results Summary: For the second quarter of 2024, Oklo’s financial statements reflect a combination of ongoing business activities that continue to scale up, as well as several one-time accounting impacts to record the merger with AltC. Approximately $37.8 million of these deal-related impacts are associated with non-cash fair market value adjustments and are represented in the $53.3 million net loss for the 6-month period. For the full year 2024 forecast, Oklo’s management believes remain on target to meet the operating loss estimate of $40-50 million.

■ Revenue Growth: While Oklo is not generating significant revenue yet, the partnerships it has secured, such as the 500MW deal with Equinix, signal future revenue potential. The company's revenue is expected to see exponential growth once its reactors are online.

■ Four macro trends are driving demand for Oklo’s baseload low-carbon power:

2.1 Key Growth Drivers

• Rising demand from AI and tech firms for clean energy solutions: Scalable technology provides Oklo with a broad and diverse customer base and growing project pipeline

• Technological innovations in nuclear power: Oklo is developing advanced fast fission reactors that can run on fresh fuel or recycled nuclear waste:

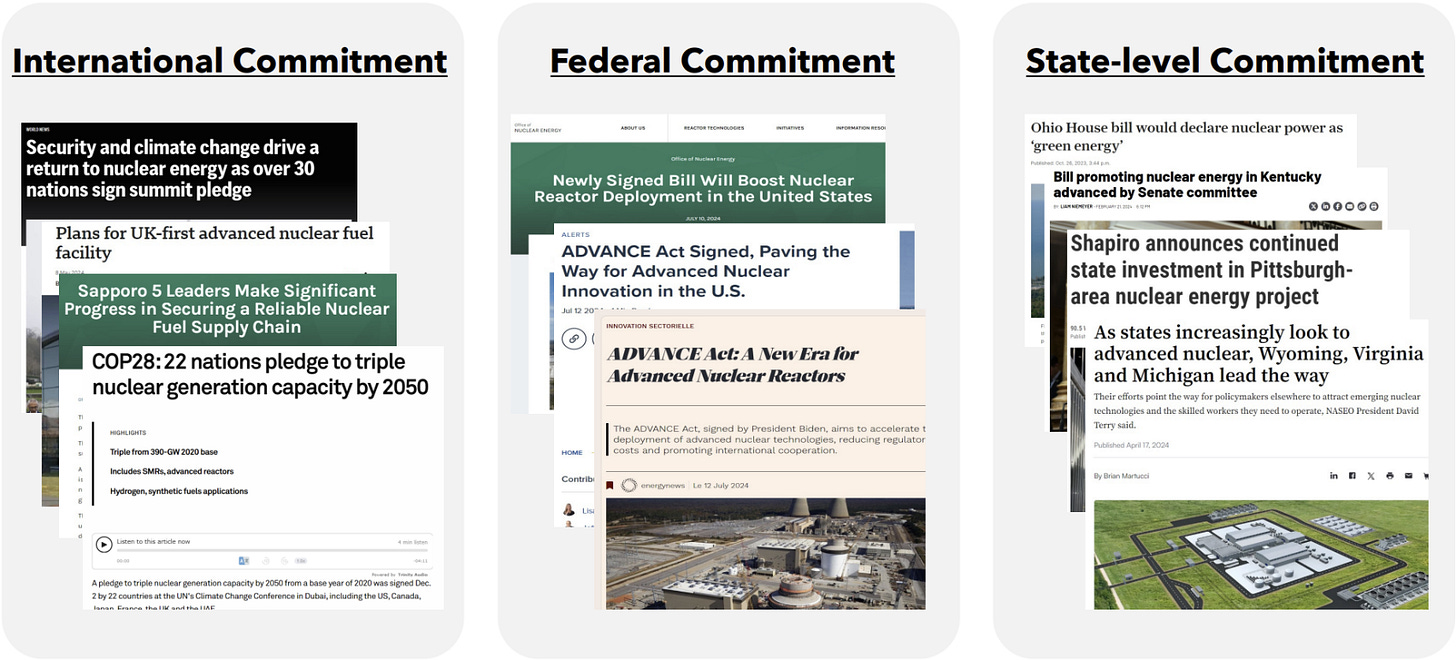

• Government support for clean energy initiatives and regulatory approvals: The nuclear sector is receiving unprecedented support from all levels of government:

• By leveraging the energy density of fission, Oklo's Aurora powerhouses have immense environmental benefitst:

Lowest GHG emission: Nuclear power has the lowest lifecycle GHG emissions profile of any energy technology, including solar and onshore wind

Lowest materials use: Nuclear power has the lowest materials intensity of any energy technology

Lowest land use: Nuclear power uses the least amount of land of any energy technology

2.2 Why Oklo

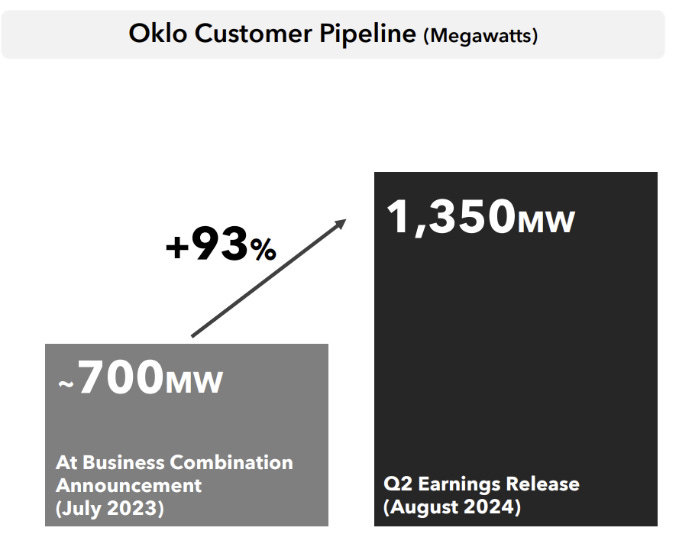

■ Customer pipeline: Oklo’s customer pipeline has nearly doubled since their business combination announcement in July 2023: Customer pipeline summary:

Data center customer demand is the primary segment driving pipeline growth

Customer demand is risk weighted based on the status of customer agreements

Oklo is working with customers to convert non-binding Letters of Intent and Term Sheets into Power Purchase Agreements in H2 2024 and H1 2025

■ Oklo has a leading market position and first mover advantage in the advanced nuclear sector:

Noteworthy regulatory progress with the NRC and industry leading combined licensing strategy

Small scalable technology reduces megaproject execution risk and time to market

Well capitalized balance sheet provides the company with funds to execute its business plan and complete first deployments

Federal funding programs, project finance and tax equity expected to reduce investments into projects and reduce cost of capital

■ Attractive business model targeting recurring cashflows:

o Power Sales

Build, Own, Operate business model

Sell low-carbon power direct to customers under long term PPA’s

Scalable technology meets diverse customer needs and locations

Selling power instead of reactors relieves regulatory, development, and construction burden on customers

o Fuel reciclying:

Proven nuclear fuel recycling technology

Oklo can tap into remaining 95% of energy left in spent Uranium

Conversion of radioactive nuclear waste into usable energy

Utilize existing 90,000 MT of spent nuclear waste at nuclear power station sites

Reduce fuel costs by over 80% by leveraging recycled fuel

■ Building multiple small reactors at project sites vs. single large reactors has benefits for Oklo and its customers:

o Oklo Benefits:

Avoids mega-project execution risk

Higher product volumes reduce supply chain and pre-fabrication costs

More repeated onsite installations reduce labor costs and project timelines

Accelerated path down the cost curve

o Customer benefits:

Flexible sizing from MW to GW scale meets small to large customer needs

Phased Aurora powerhouse installation timelines match well with phased customer timelines

Reduced grid interconnection and infrastructure costs

Higher reliability and redundancy by using multiple reactors for power supply

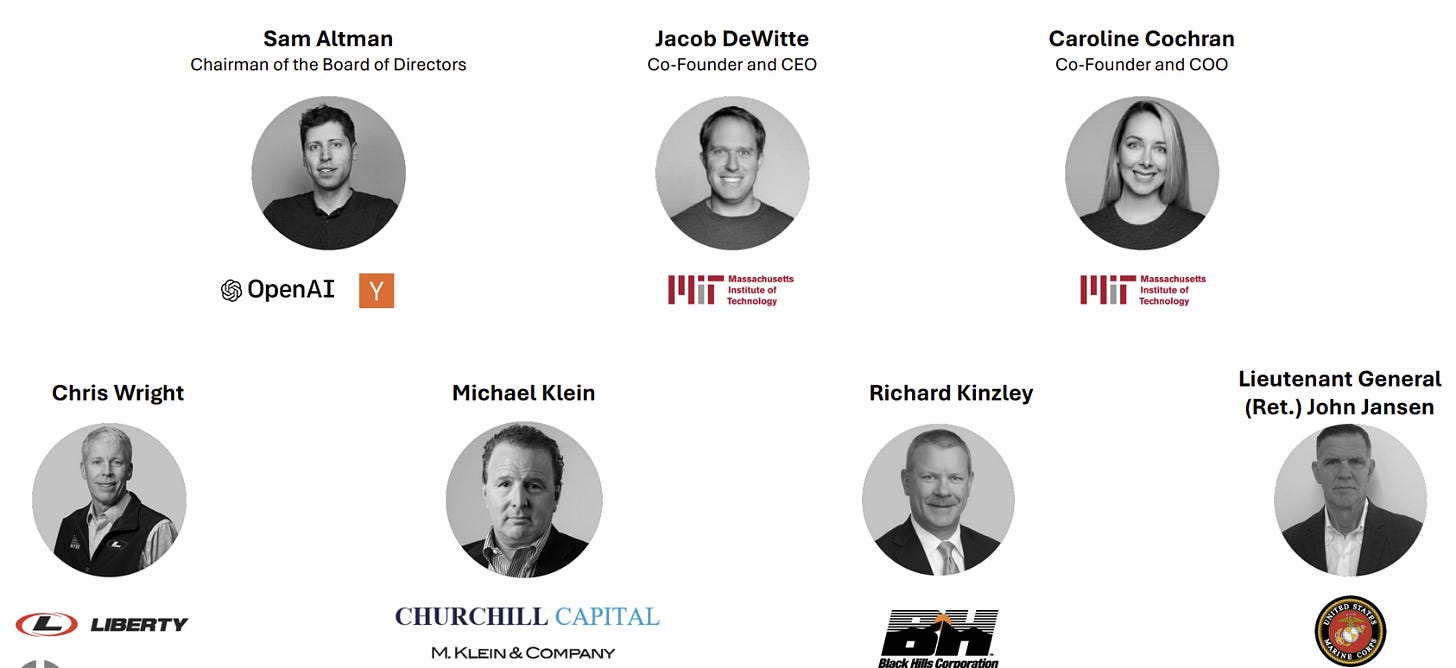

■ World-class board of directors with backgrounds in energy, defense, oil and gas, utilities, capital markets, and artificial intelligence:

2.3 Timeline

■ Key milestones achieved in H1 2024 23

U.S. DOE Approved the Safety Design Strategy for the Oklo Aurora Fuel Fabrication Facility

Oklo Entered into Land Rights Agreement to Advance Deployment of Two Aurora Powerhouses in Southern Ohio

Oklo and Argonne Achieved Milestone in Thermal-Hydraulic Testing Campaign

Signed LOI to Supply 50 Megawatts of Power to Diamondback Energy

Oklo Began Trading on the New York Stock Exchange under the symbol "OKLO"

Signed MOU with Atomic Alchemy to Collaborate on Isotope Production

Partnered with Wyoming Hyperscale to Deliver 100 Megawatts to its Data Centers

Completed successful end-to-end demonstration of advanced fuel recycling process

■ Key milestones achieved in H1 2024 23:

o Prior to 2027: Licensing and First Deployment

Oklo intends to be the first advanced nuclear company to receive a Combined License Approval from the NRC

Demonstration fuel fabrication facility to be built at INL

Aurora-1 to be the first advanced nuclear reactor expected to be completed in the U.S.

Construction expected to begin on commercial fuel fabrication facilities

o 2027-2030: Initial Deployments and Fuel Fabrication

Oklo intends to be the first advanced nuclear company to receive a Combined License Approval from the NRC

Demonstration fuel fabrication facility to be built at INL

Aurora-1 to be the first advanced nuclear reactor expected to be completed in the U.S.

Construction expected to begin on commercial fuel fabrication facilities

o 2030+: Deployments at Scale and Fuel Recycling

Powerhouses of all sizes to be deployed to customer sites at scale

Commercial fresh fuel and fuel recycling facilities to supply fuel to Powerhouses at scale

3. Thesis

Oklo’s potential lies in its ability to meet the growing power demands of AI and tech companies with clean, reliable energy. As more tech giants turn to nuclear energy, Oklo is well-positioned to capture a significant share of this market.

3.1 Catalysts:

Additional power purchase agreements (PPAs) with large tech companies.

Regulatory milestones for its reactors.

Expansion of nuclear energy incentives and government support.

3.2 Calendar:

2025-2027: Key regulatory approvals and development milestones for its reactors.

2027: First commercial reactor expected to come online.

3.3 Risks:

Regulatory hurdles could delay the deployment of reactors.

High short interest suggests market skepticism.

Competitive pressures from other nuclear startups like Kairos Power.

4. SWOT Analysis

■ Strengths: Technological innovation, strategic partnerships, strong backing from investors like Sam Altman.

■ Weaknesses: Pre-revenue stage, dependent on future approvals and deployments.

■ Opportunities: Rising demand for clean energy, particularly from the AI sector.

■ Threats: Regulatory risks, competition from other nuclear energy startups.

5. Conclusions

Oklo offers a speculative but potentially high-reward outlook as a pioneer in nuclear energy solutions tailored to the power-hungry AI sector. While the company faces significant risks related to regulatory approval and reactor deployment timelines, the growing demand from tech companies provides substantial upside potential.

Bibliography

Oklo, Inc. Q2 2024 Financial Results and Company Updates.

Benzinga (2024). "Oklo CEO Highlights Demand for AI Power."

MarketBeat (2024). "Oklo Stock Price, News, and Analysis."

Yahoo Finance (2024). "Sam Altman-backed Oklo Reacts to Google's Nuclear Energy Deal.

Prepared by AI Monaco

AI Monaco is a leading-edge research firm that specializes in utilizing AI-powered analytics and data-driven insights to provide clients with exceptional market intelligence. We focus on offering deep dives into key sectors like AI technologies, data analytics and innovative tech industries.