REMINDER: THIS IS THE LAST FREE ARTICLE OF THIS SERIES

As organizations prioritize customer experience and regulatory compliance, the demand for sophisticated, AI-powered software solutions is surging. NICE Ltd. (NASDAQ: NICE) stands at the forefront of this transformation, offering innovative cloud-based platforms that enhance customer engagement and ensure compliance through advanced analytics and artificial intelligence.

Our analysis delves into NICE's strategic positioning, technological advancements, and growth prospects within the expanding market for customer experience and compliance solutions. We will assess how macroeconomic factors, technological trends, and competitive dynamics are shaping the industry. Join us as we explore whether NICE Ltd. has the competitive edge to solidify its leadership in this critical and rapidly evolving sector.

Executive Summary

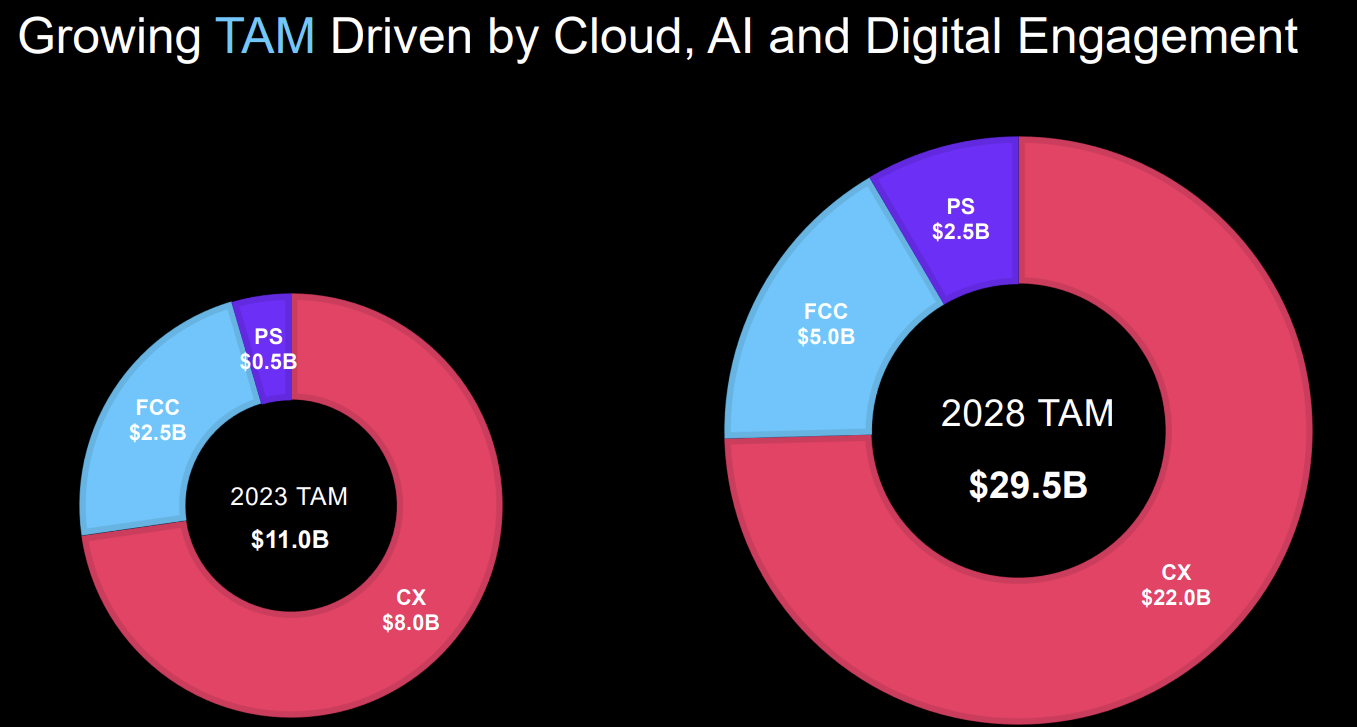

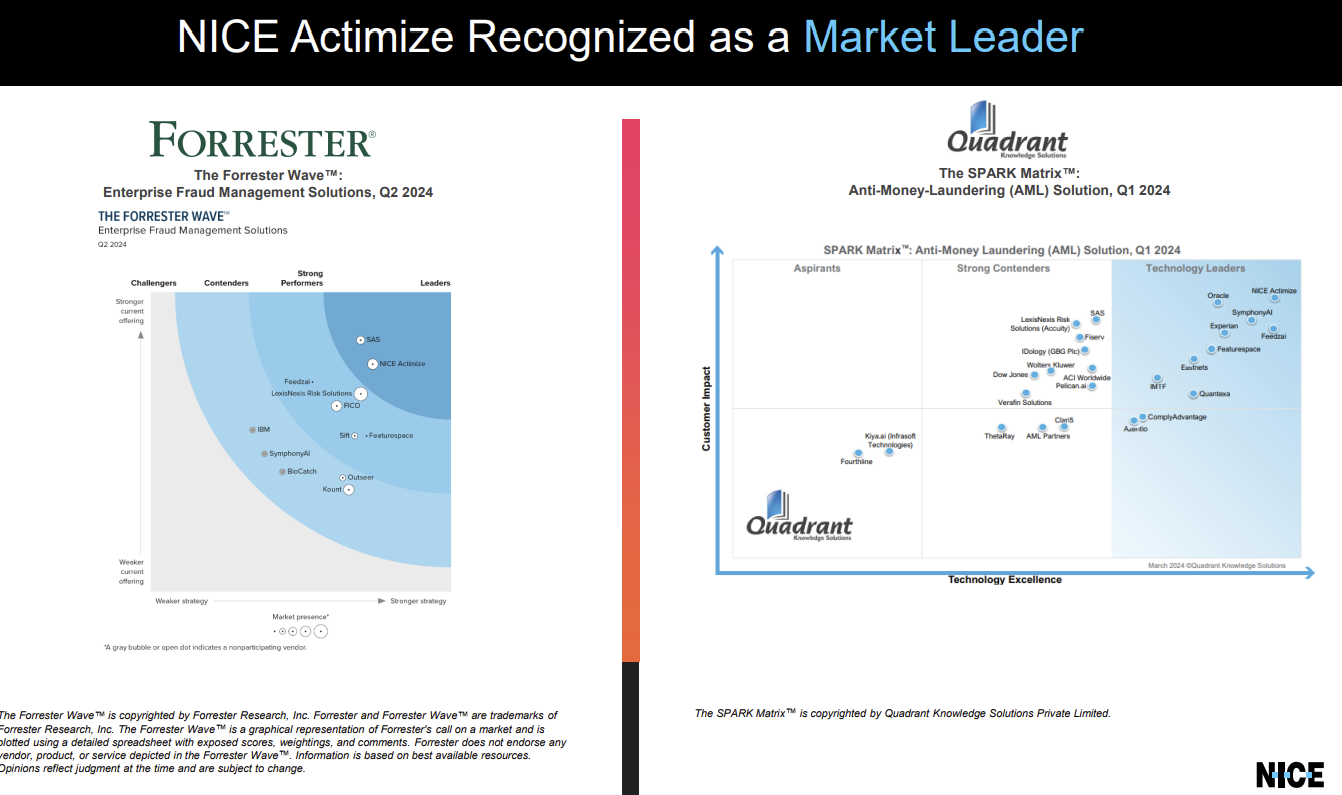

Case study: The global customer experience management market is projected to reach $27.1 billion by 2028, growing at a CAGR of 17.5% from 2021 to 2028. NICE Ltd., with its comprehensive suite of AI-driven solutions, is well-positioned to capitalize on this growth. The company's cloud-native platforms, including NICE CXone and NICE Actimize, offer enterprises robust tools for customer engagement and financial crime prevention.

Key Highlights:

Strong Financial Performance: In Q3 2024, NICE reported total revenue of $690 million, a 15% year-over-year increase, surpassing analyst expectations.

Cloud Growth Momentum: The company achieved over $2 billion in cloud Annual Recurring Revenue (ARR), reflecting robust adoption of its cloud solutions.

Innovation in AI and Analytics: NICE continues to invest in AI capabilities, enhancing its platforms with advanced analytics, machine learning, and natural language processing to deliver superior customer experiences.

Company Description

NICE Ltd. is a leading global enterprise software provider that offers cloud and on-premises solutions for customer engagement, financial crime, and compliance. The company's portfolio includes advanced analytics, AI-driven automation, and omnichannel customer experience tools that empower organizations to improve service quality, operational efficiency, and compliance adherence.

1. Sector Overview

Customer Experience and Compliance Landscape

NICE has, over nearly four decades, adeptly navigated dynamic industries by embracing innovation and adapting to evolving market demands. Recognizing three transformative technological forces—Cloudification, Digitalization, and AI-ization—the company has aligned its strategy to these shifts, leading to significant achievements. Cloudification has driven a grand refactoring of the enterprise software market, with NICE rebuilding its solutions natively in the cloud and establishing market-leading platforms like CXone, Xceed, X-sight, and EvidenCentral. Digitalization has led to a grand convergence, breaking down silos between software categories, while AI-ization facilitates a grand fusion of people, processes, and technology, streamlining operations in ways previously unattainable. NICE's leadership is underscored by its comprehensive portfolio, critical AI data foundations, global ecosystem, and strong financial position, positioning the company as a frontrunner in vast, expanding markets with high barriers to entry.

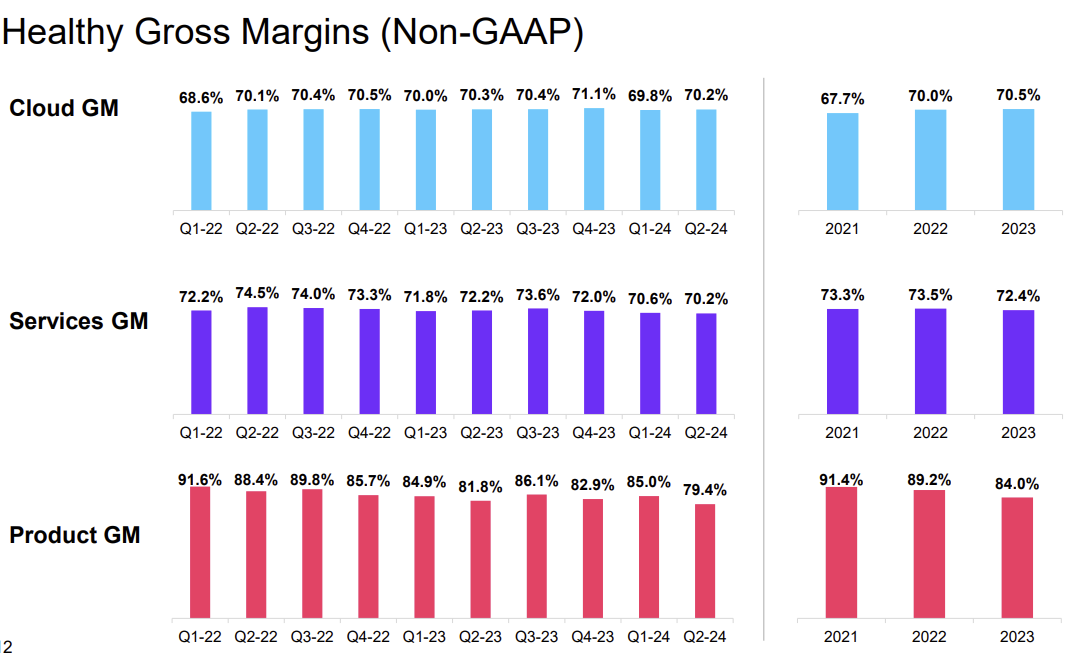

In 2023, NICE achieved significant milestones, including 22% cloud revenue growth reaching $2.4 billion in total revenue, a 70.5% non-GAAP cloud gross margin, and a 15% non-GAAP EPS growth with record cash generation of $561 million. As it enters 2024, AI stands as the catalyst propelling its growth pillars: enhancing cloud adoption with nearly 1,000 new customers; accelerating digital expansion with a 6x increase in digital engagements; powering platform adoption with a 200% growth in platform bookings; and driving new AI use cases with a 375% increase in Enlighten AI bookings. Powered by a diverse global workforce of 8,500 NICErs, the company remains committed to making a positive societal impact, aiming not just for success but to shape the future of its industry.

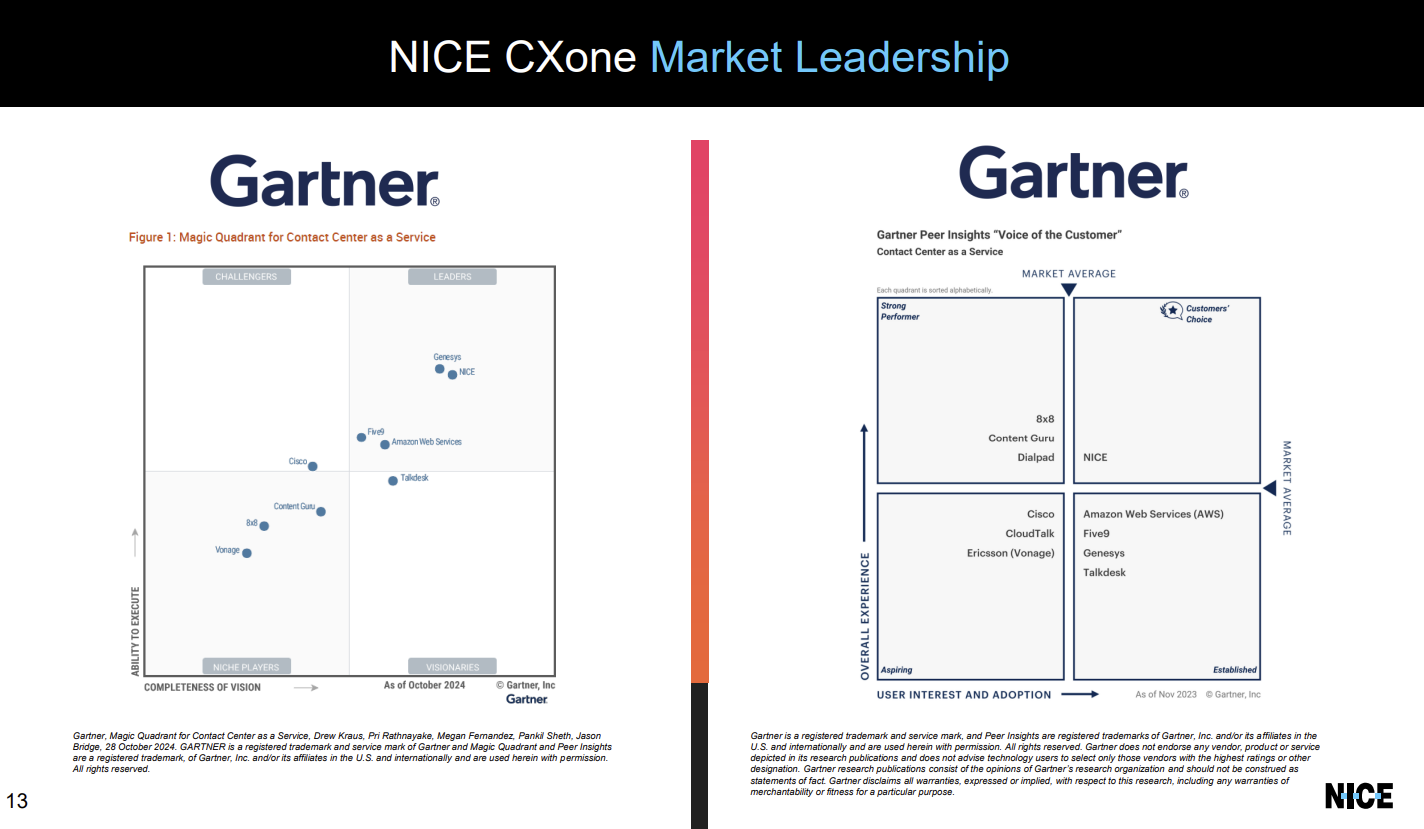

The increasing emphasis on customer satisfaction and stringent regulatory environments are driving organizations to adopt advanced solutions for customer engagement and compliance management. According to Gartner, by 2025, 75% of customer service organizations will have integrated AI in some form into their operational workflows.

Market Drivers:

Digital Transformation: The acceleration of digital initiatives has increased the demand for cloud-based customer engagement platforms.

AI and Automation: Organizations are leveraging AI to enhance customer interactions, personalize experiences, and automate routine tasks.

Regulatory Compliance: Growing regulatory scrutiny in financial services and other sectors necessitates robust compliance and risk management solutions.

2. Company analysis

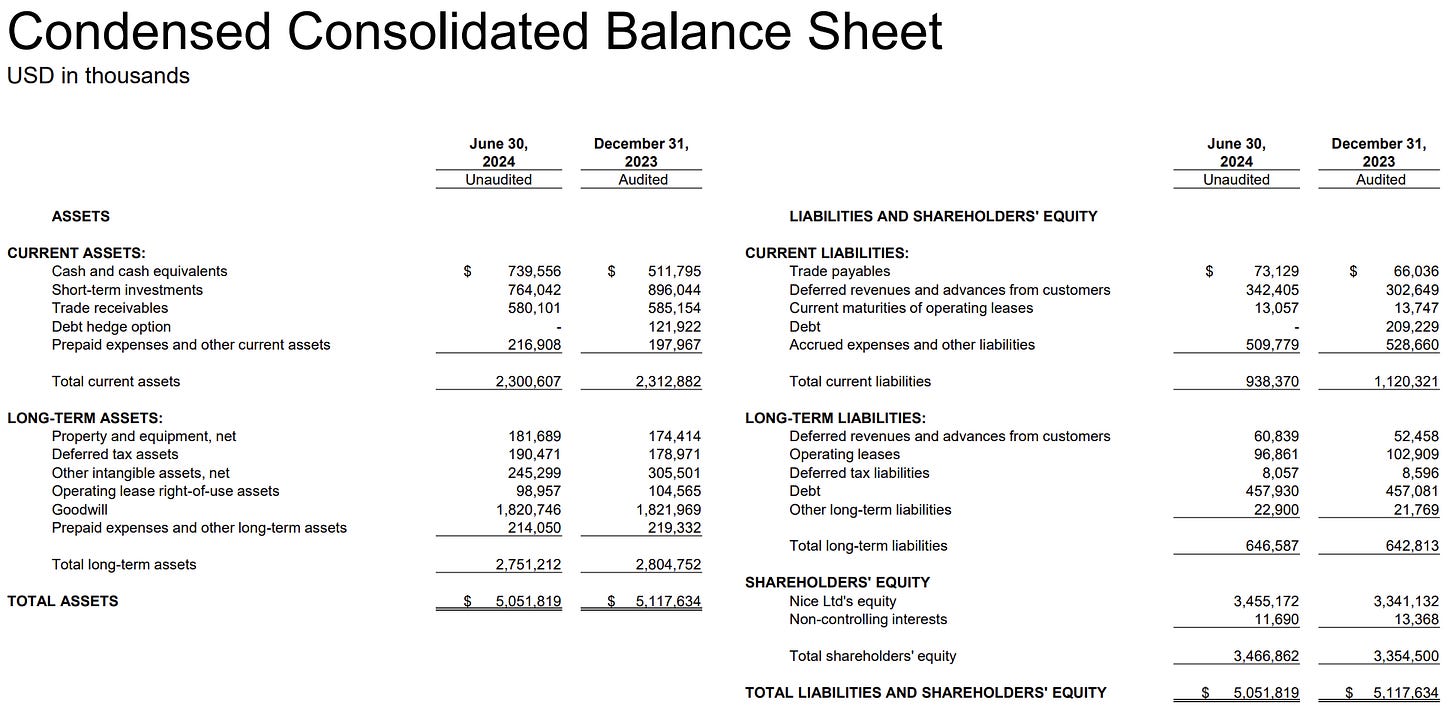

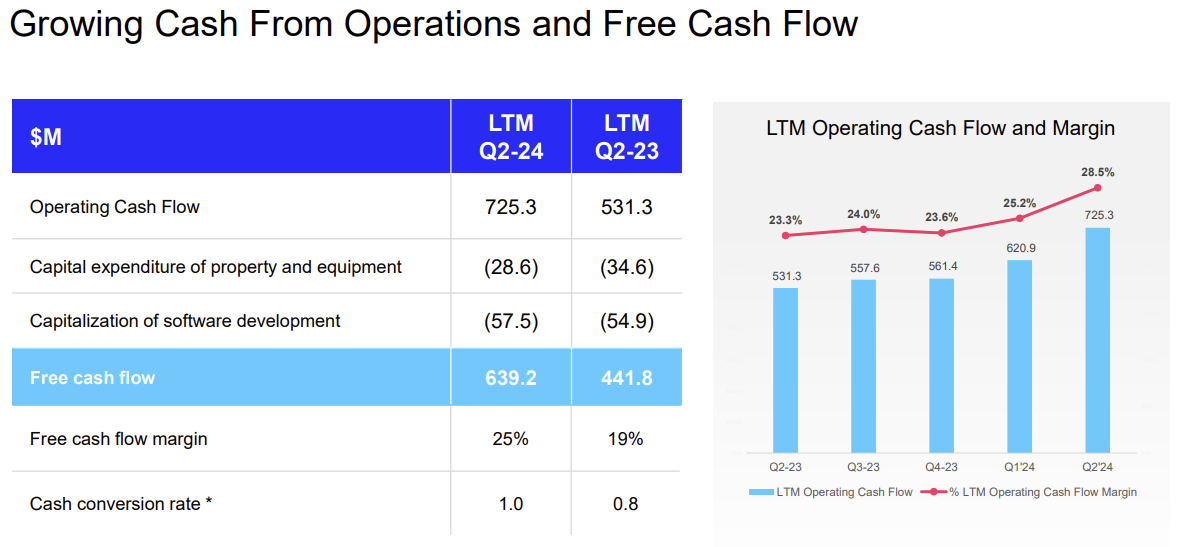

■ Balance sheet: From a financial standpoint, NICE's balance sheet reflects strong financial health and operational efficiency. As of Q2 2024, the company maintains total assets of approximately $5.05 billion, driven by substantial current assets like cash, cash equivalents, and short-term investments totalling over $1.5 billion. Shareholders’ equity stands robust at $3.47 billion, underscoring a solid equity foundation. On the liabilities side, NICE exhibits prudent financial management with manageable long-term debt of $458 million and consistent deferred revenues, indicative of recurring income streams. The company’s strong cash flow generation, with $764 million in cash from operations, coupled with significant free cash flow margins, highlights its capability to invest in growth while sustaining shareholder returns through share repurchases

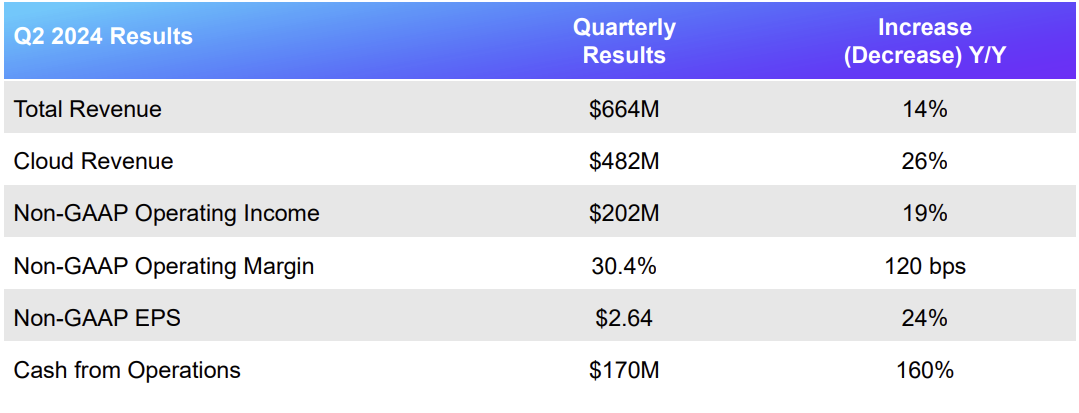

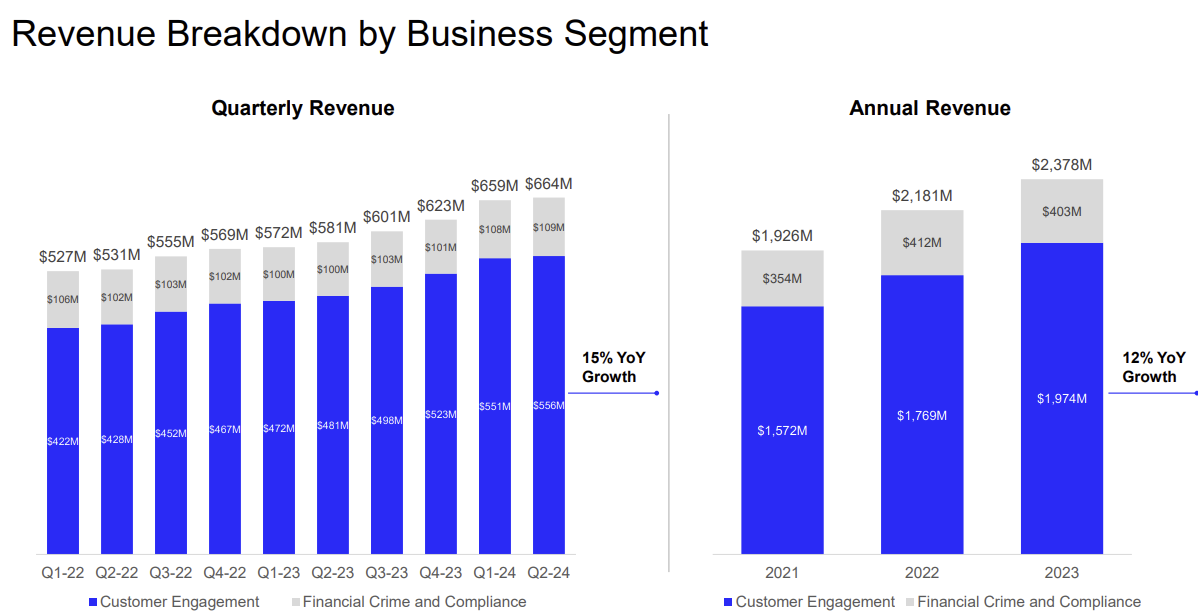

■ Q2 Earnings results : NICE's Q2 2024 earnings demonstrated significant financial strength, with adjusted earnings per share (EPS) reaching $2.64, reflecting a 24% year-over-year increase. The company achieved total revenues of $664 million, up 14% year-over-year, with cloud revenue driving growth at 26% year-over-year to $482 million. Operating income improved by 19% year-over-year to $202 million, with a 30.4% operating margin. Additionally, operating cash flow surged 160% year-over-year to $170 million, showcasing the company's robust liquidity and operational efficiency. These results underscore NICE's strong focus on cloud-based offerings and operational leverage.

■ Q3 Earnings results: In Q3 2024, NICE surpassed expectations, reporting adjusted EPS of $2.88, a 27% year-over-year increase, and beating the Zacks Consensus Estimate by 7.46%. Non-GAAP revenues reached $690 million, up 15% year-over-year and 1.07% above consensus, driven by cloud business strength and customer base expansion. Cloud revenues accounted for $500 million, growing 24% year-over-year, and NICE achieved over $2 billion in Annual Recurring Revenue from its cloud offerings.

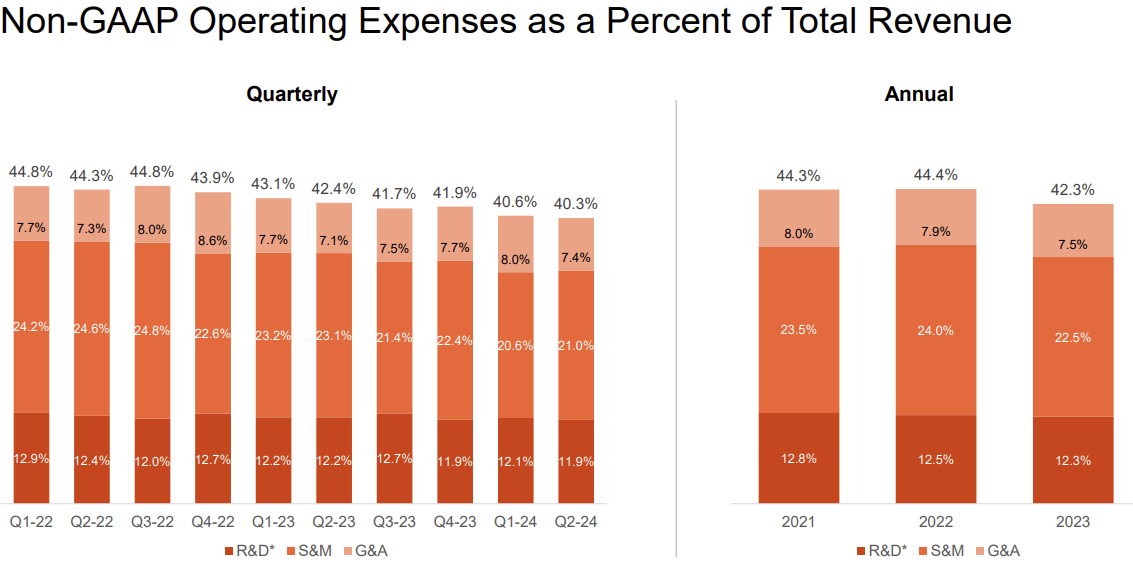

Customer Engagement revenues rose 15% to $578 million, while Financial Crime & Compliance grew 8% to $111 million. However, margins were under slight pressure, with a 71.1% gross margin (down 120 bps year-over-year) and a 69.7% cloud margin (down 70 bps). Non-GAAP operating expenses decreased as a percentage of revenue by 260 bps to 39.1%, driving an expanded operating margin of 32%, up 140 bps year-over-year.

Geographically, revenues in the Americas rose 17% year-over-year to $587 million, while EMEA increased 14% to $69 million. APAC revenues declined 12% to $34 million. As of September 30, 2024, NICE had cash and equivalents of $1.52 billion and long-term debt of $458.4 million. The company allocated $86.4 million for share repurchases during the quarter. Cash flow from operations was $159 million

Revenue Growth:

Total Revenue: $557 million, up 9% year-over-year.

Cloud Revenue: $311 million, an increase of 25% year-over-year.

Product Revenue: Declined due to the strategic shift towards cloud solutions.

Profitability and Margins:

Non-GAAP Gross Margin: Improved to 72% from 70% in the prior year.

Non-GAAP Operating Income: Reached $168 million, representing a 10% increase year-over-year.

Non-GAAP Operating Margin: Expanded to 30%, up from 29% in Q2 2022.

2.1 Growth drivers

■ Key growth drivers:

Cloud Transition Success: The ongoing shift from on-premises to cloud solutions is driving recurring revenue growth and higher margins.

AI-Powered Innovations: Launch of new AI-driven features, such as Enlighten AI, enhances the value proposition of NICE's platforms.

Market Expansion: Increased penetration in international markets and among small to medium-sized businesses (SMBs) expands the customer base.

2.2 Valuation

Current Share Price:

Price: $171

Market Capitalization: Approximately $10 billion

Multiples:

Forward (P/E) Ratio: 25x, reflecting investor confidence in NICE's growth prospects.

EV/EBITDA (Fwd): 16x, in line with industry peers like Verint Systems and lower than high-growth SaaS companies.

DCF Valuation:

Based on a discounted cash flow (DCF) model:

Intrinsic Value Estimate: $250 per share.

Key Assumptions:

Revenue CAGR (2023-2028): 10%

Discount Rate (Cost of Capital): 8%

Terminal Growth Rate: 2.5%

Margin Expansion: Anticipated improvement in operating margins due to economies of scale and increased cloud adoption.

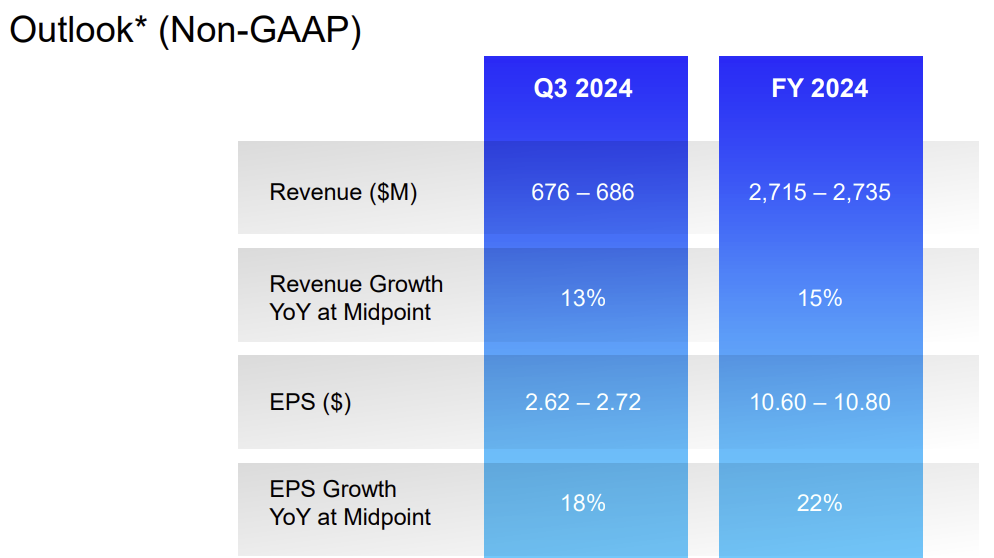

■ Financial outlook:

Full-Year guidance:

NICE has provided a positive financial outlook for FY 2024, projecting non-GAAP revenues in the range of $2.715 billion to $2.735 billion, representing 15% year-over-year growth at the midpoint. The company also anticipates non-GAAP earnings per share (EPS) between $10.95 and $11.50, indicating a 26% year-over-year increase at the midpoint. This optimistic guidance reflects strong momentum in its cloud and AI-driven offerings, particularly the continued adoption of the CXone platform and advanced customer service automation solutions. With a robust pipeline of recurring revenue, operational efficiency, and significant growth opportunities in cloud and AI, NICE is well-positioned to deliver sustained financial performance

2.3 Thesis, catalysts and risks

Thesis:

NICE Ltd.'s leadership in AI-driven customer engagement and compliance solutions positions it favourably within a growing market. The company's successful transition to cloud-based offerings and continuous innovation in AI and analytics are key differentiators that drive sustainable growth and profitability.

Catalysts:

Accelerated Cloud Adoption: Continued migration of customers to cloud platforms increases recurring revenues and margins.

AI Innovation: Enhancements in AI capabilities, such as predictive analytics and real-time sentiment analysis, attract new clients and upsell opportunities.

Strategic Acquisitions: Potential acquisitions could expand product offerings and market reach.

Risks:

Competitive Pressure: Intensifying competition from other software providers, including Salesforce and Genesys, could impact market share.

Economic Uncertainty: Macroeconomic headwinds may lead to reduced IT spending by clients.

Regulatory Changes: Evolving data privacy laws and regulations could necessitate additional compliance measures, affecting operational costs.

3. SWOT analysis and analyst recommendations

Strengths:

Market Leadership: Dominant in CX, FCC, and PSJ.

Technological Innovation: Proprietary AI solutions like Enlighten AI.

Robust Financials: $764 million in cash flow with 30% non-GAAP operating margins.

Weaknesses:

Transition Risks: Challenges in balancing legacy systems with new cloud strategies.

Geographic Reliance: Overdependence on North America.

Opportunities:

AI Integration: Rapid adoption in AI-driven automation.

Emerging Markets: Expanding into underpenetrated regions.

Cross-Selling Potential: Leveraging the breadth of NICE's portfolio for upselling.

Threats:

Intense Competition: From players like Salesforce and Genesys.

Economic Pressures: Potential IT budget cuts due to macroeconomic conditions.

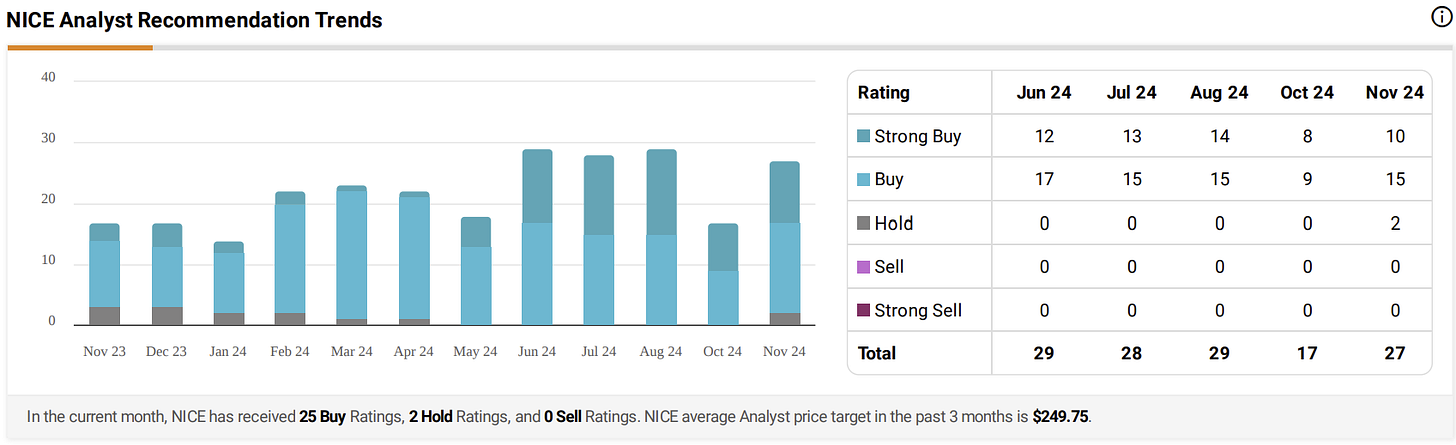

■ Analyst recommendations: Based on 14 Wall Street analysts offering 12 month price targets for NICE in the last 3 months. The average price target is $249.75 with a high forecast of $334.00 and a low forecast of $187.00. The average price target represents a 43.67% change from the last price of $173.83.

4. Conclusions

NICE Ltd. demonstrates a solid growth trajectory supported by its strategic focus on cloud solutions and AI-driven innovations. The company's robust financial performance, combined with its leadership in customer engagement and compliance markets, positions it well to capitalize on industry trends. While competitive and macroeconomic challenges exist, NICE's strengths and opportunities present a compelling case for long-term holders.

Bibliography

NICE Ltd. (2024). Earnings Release and Financial Results. Retrieved from NICE Investor Relations

Gartner. (2021). Predicts 2025: Customer Service and Support. Gartner Research. Retrieved from Gartner Reports

Yahoo Finance. (2023). NICE Ltd. (NICE) Stock Price, News, Quote & History. Retrieved from Yahoo Finance

Bloomberg. (2023). NICE Ltd. Company Profile and Stock Analysis. Retrieved from Bloomberg Markets

Prepared by AI Monaco

AI Monaco is a leading-edge research firm that specializes in utilizing AI-powered analytics and data-driven insights to provide clients with exceptional market intelligence. We focus on offering deep dives into key sectors like AI technologies, data analytics and innovative tech industries.